In its five-decade history, Kenanga Investment Bank Bhd has been focusing on serving institutional clients. But the bank is looking to alter its narrative by tapping the retail market with Kenanga Digital Investing (KDI), a fully automated artificial intelligence (Al)-driven robo-advisor.

Its chief digital officer Ian Lloyd tells Wealth that the bank wanted to find a way to reach more people as well as make saving and investing simple and easy for Malaysians, which is why user experience and accessibility are at the forefront of the app.

“It’s easy to invest in the wrong stock at the wrong time, especially if you’re completely new to investing. Since a year ago, we kept thinking about what we could do to make investing easier for people and that’s when we decided on a robo-advisor,” he says.

KDI seems to be fulfilling its purpose as it is gaining eyeballs from its target market. Lloyd says since KDI was launched on Feb 15, it has garnered over 6,000 users and about half of them are from the B40 (low-income) bracket. Lloyd says this is promising news for the bank, especially since they assumed that new investment products would reach affluent investors first.

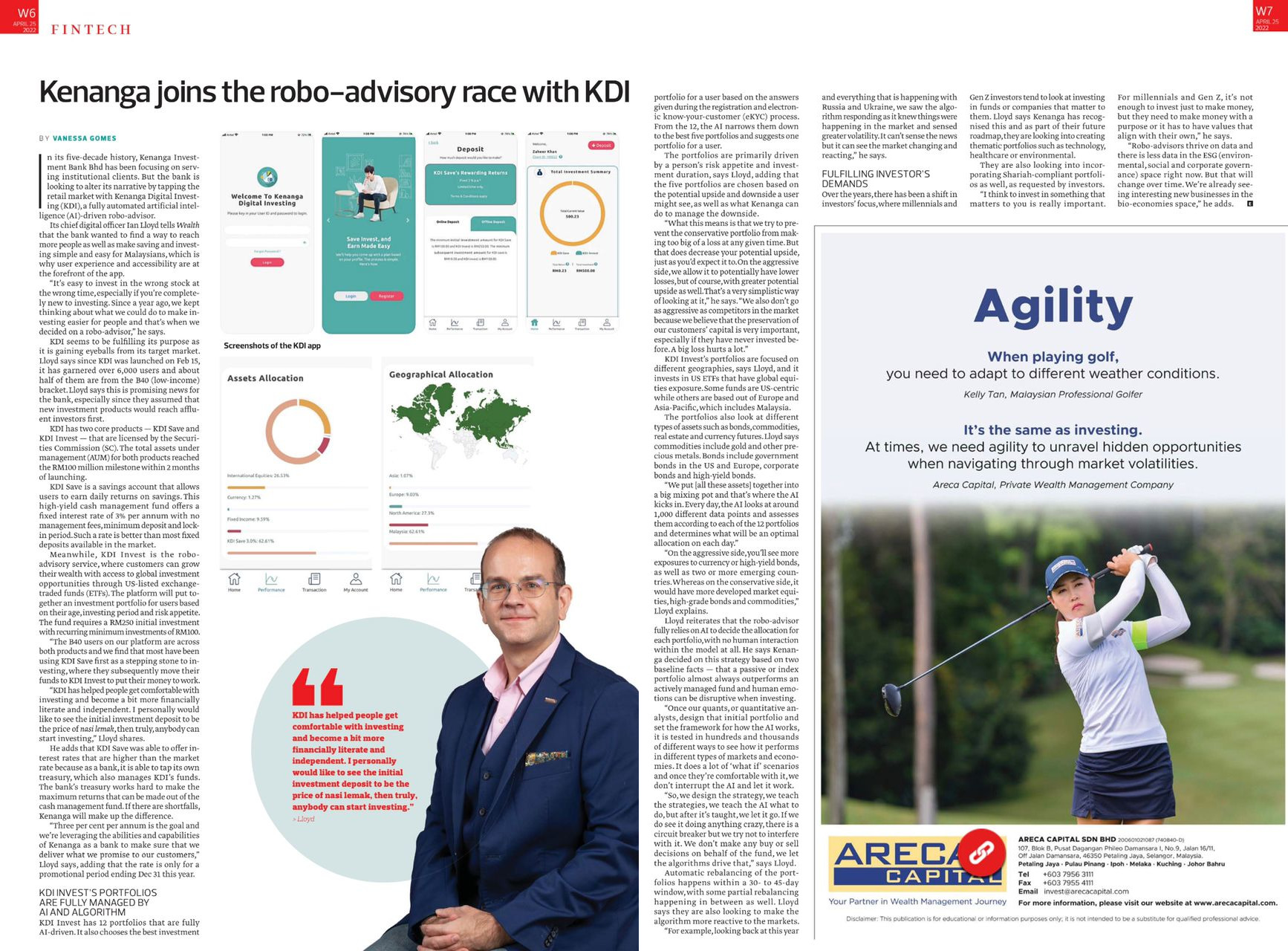

KDI has two core products — KDI Save and KDI Invest — that are licensed by the Securities Commission (SC). The total assets under management (AUM) for both products reached the RM100 million milestone within 2 months of launching.

KDI Save is a savings account that allows users to earn daily returns on savings. This high-yield cash management fund offers a fixed interest rate of 3% per annum with no management fees, minimum deposit and lock in. period. Such a rate is better than most fixed deposits available in the market.

Meanwhile, KDI Invest is the robo- advisory service, where customers can grow their wealth with access to global investment opportunities through US-listed exchange- traded. funds (ETFs).The platform will put together an investment portfolio for users based on their age, investing period and risk appetite. The fund requires a RM250 initial investment with recurring minimum investments of RM100.

“The B40 users on our platform are across both products and we find that most have been using KDI Save first as a stepping stone to investing, where they subsequently move their funds to KDI Invest to put their money to work.

“KDI has helped people get comfortable with investing and become a bit more financially literate and independent. I personally would like to see the initial investment deposit to be the price of nasi lemak, then truly, anybody can start investing,” Lloyd shares.

He adds that KDI Save was able to offer interest rates that are higher than the market rate because as a bank, it is able to tap its own treasury, which also manages KDI’s funds. The bank’s treasury works hard to make the maximum returns that can be made out of the cash management fund. If there are shortfalls, Kenanga will make up the difference.

“Three per cent per annum is the goal and we’re leveraging the abilities and capabilities of Kenanga as a bank to make sure that we deliver what we promise to our customers,” Lloyd says, adding that the rate is only for a promotional period ending Dec 31 this year.

KDI INVEST’S PORTFOLIOS ARE FULLY MANAGED BY AI AND ALGORITHM

KDI Invest has 12 portfolios that are fully Al-driven. It also chooses the best investment portfolio for a user based on the answers given during the registration and electronic know-your-customer (eKYC) process. From the 12, the AI narrows them down to the best five portfolios and suggests one portfolio for a user.

The portfolios are primarily driven by a person’s risk appetite and investment duration, says Lloyd, adding that the five portfolios are chosen based on the potential upside and downside a user might see, as well as what Kenanga can do to manage the downside.

“What this means is that we try to prevent the conservative portfolio from making too big of a loss at any given time. But that does decrease your potential upside, just as you’d expect it to. On the aggressive side, we allow it to potentially have lower losses, but of course, with greater potential upside as well. That’s a very simplistic way of looking at it,“ he says. “We also don’t go as aggressive as competitors in the market because we believe that the preservation of our customers’ capital is very important, especially if they have never invested before. A big loss hurts a lot.”

KDI Invest’s portfolios are focused on different geographies, says Lloyd, and it invests in US ETFs that have global equities exposure. Some funds are US-centric while others are based out of Europe and Asia-Pacific, which includes Malaysia.

The portfolios also look at different types of assets such as bonds, commodities, real estate and currency futures. Lloyd says commodities include gold and other precious metals. Bonds include government bonds in the US and Europe, corporate bonds and high-yield bonds.

“We put [all these assets] together into a big mixing pot and that’s where the Al kicks in. Every day, the AI looks at around 1,000 different data points and assesses them according to each of the 12 portfolios and determines what will be an optimal allocation on each day.”

“On the aggressive side, you’ll see more exposures to currency or high-yield bonds, as well as two or more emerging countries. Whereas on the conservative side, it would have more developed market equities, high-grade bonds and commodities,” Lloyd explains.

Lloyd reiterates that the robo-advisor fully relies on AI to decide the allocation for each portfolio, with no human interaction within the model at all. He says Kenanga decided on this strategy based on two baseline facts — that a passive or index portfolio almost always outperforms an actively managed fund and human emotions can be disruptive when investing,

“Once our quants, or quantitative analysts, design that initial portfolio and set the framework for how the AI works, it is tested in hundreds and thousands of different ways to see how it performs in different types of markets and economies. It does a lot of ‘what if’ scenarios and once they’re comfortable with it, we don’t interrupt the Al and let it work.

“So, we design the strategy, we teach the strategies, we teach the AI what to do, but after it’s taught, we let it go. If we do see it doing anything crazy, there is a circuit breaker but we try not to interfere with it. We don’t make any buy or sell decisions on behalf of the fund, we let the algorithms drive that,” says Lloyd.

Automatic rebalancing of the portfolios happens within a 30- to 45-day window, with some partial rebalancing happening in between as well. Lloyd says they are also looking to make the algorithm more reactive to the markets.

“For example, looking back at this year and everything that is happening with Russia and Ukraine, we saw the algorithm responding as it knew things were happening in the market and sensed greater volatility. It can’t sense the news but it can see the market changing and reacting,” he says.

FULFILLING INVESTOR’S DEMANDS

Over the years, there has been a shift in investors’ focus, where millennials and Gen Z investors tend to look at investing in funds or companies that matter to them. Lloyd says Kenanga has recognised this and as part of their future roadmap, they are looking into creating thematic portfolios such as technology, healthcare or environmental.

They are also looking into incorporating Shariah-compliant portfolios as well, as requested by investors.

“I think to invest in something that matters to you is really important. For millennials and Gen Z, it’s not enough to invest just to make money, but they need to make money with a purpose or it has to have values that align with their own,” he says.

“Robo-advisors thrive on data and there is less data in the ESG (environ mental, social and corporate governance) space right now. But that will change over time. We’re already seeing interesting new businesses in the bio-economies space,” he adds.

By Vanessa Gomes